Investing in Dubai’s real estate market can be highly profitable. There are numerous residences to fit different lifestyles and financial objectives. However, the process of buying apartments in Dubai can be intimidating, especially for first-time buyers.

Buying an apartment in Dubai is straightforward if you know what you want and where to look. Dubai has apartments for all lifestyles and budgets, whether you live there, are new to the city, or want to invest. To learn about down payment, interest rates, and qualifications for a mortgage in Dubai, talk to banks or mortgage experts. It’s a good idea to work with a trusted real estate developer when looking for an apartment. This can make the process easier. This guide outlines the steps and considerations to help you make the best decision.

Why Buy Apartments in Dubai?

Dubai’s properties, first-class facilities, and prime location attract global interest from buyers. Here are key reasons to buy an apartment in Dubai:

Attractive Rental Yields:

Dubai’s strong tourism sector and booming economy make apartments a desirable investment.

Variety of Property Options:

Dubai offers a wide range of properties, from studio flats to penthouses.

Tax-Free Environment:

No yearly property taxes in Dubai, maximizing your profits.

Cosmopolitan Lifestyle:

Dubai’s mix of modern infrastructure, cultural diversity, and leisure activities appeals to expats and visitors alike.

Step 1: Determine Your Budget and Financing Options

Decide on a budget before looking for an apartment, taking into account savings, possible rental income, and any loans or mortgages. Plan your budget before searching for an apartment, considering savings, potential rental income, and any loans or mortgages. Financing options include conventional mortgages and Islamic financing solutions like Murabaha from Dubai’s banks. If you are taking out a mortgage, you will need to obtain an NOC (No Objection Certificate) from your bank or lender. This document confirms that the lender has no objection to the property being registered in your name.

Our Tip: To find out the down payment, interest rates, and qualifying standards for getting a mortgage in Dubai, speak with banks or mortgage experts.

Read our guide The Ultimate Guide to Getting a Mortgage for Property in Dubai

Step 2: Selecting the Right Location

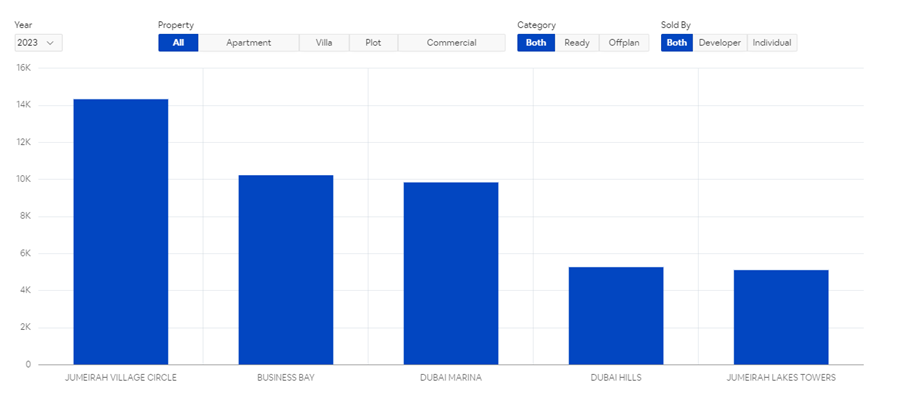

Location, location, location is crucial when buying an apartment in Dubai. Consider proximity to your job, schools, hospitals, and amenities like restaurants, shopping centers, and entertainment venues. Popular areas include Dubai Marina, Downtown Dubai, Palm Jumeirah, and Jumeirah Beach Residence (JBR).

Our Tip: Visit the areas and communities where your preferred apartment developments are located. You will be able to get a feel of how the location fits with your buying criteria.

Step 3: Working with a Reputable Real Estate Developer

While you can search for an apartment on your own, selecting a reputable real estate developer who you can trust will ensure a smoother process. Developers have extensive market knowledge, construction expertise, and access to prime locations and exclusive projects.

Property developers must do research and evaluate properties before starting new projects. Feasibility studies and valuations are important steps in their operations. This assessment looks at market demand, potential profits, and if a development is viable. It considers factors like location, zoning rules, building costs, and expected sales prices. Their team of experts, including market analysts, architects, engineers, and construction professionals, work together to ensure accurate valuations and successful project execution.

Developers know the real estate market well. They find good opportunities and build attractive properties that meet the needs of buyers and investors. Their strong financial backing, negotiation skills, and industry connections further contribute to their ability to deliver exceptional real estate projects.

If you are not a resident, you need a UAE residency visa or entry permit to buy property in the UAE. The developer can assist you with the paperwork and legal requirements for purchasing a property in the UAE.

Our Tip: Make sure developers are licensed by the Dubai Land Department (DLD), check out their reviews, and do your homework by comparing them with other developers.

Step 4: Choosing Off-Plan or Ready Properties

Dubai offers two main choices: ready properties and off-plan properties. Off-plan properties are less expensive but have longer waits and potential construction delays. Ready properties are “turn-key” but more expensive.

Significant capital appreciation is one of the potential key benefits of purchasing an off-plan property.

Pre-built and situated in established or developing neighborhoods, these residences typically appreciate in value over time. For individuals wishing to profit financially from their purchase, they offer an excellent opportunity to receive a solid return on their investment when they do decide to sell.

Buyer interest can be extremely high in newly launched projects so registering your interest early with the developer is recommended.

Read our guide Dubai Off-Plan Property Market: Pros and Cons for Buyers

Our Tip: When choosing between off-plan and ready-to-move-in houses, take into consideration factors such as your budget, timeframe, and risk tolerance.

Step 5: Conducting Thorough Due Diligence

Thorough due diligence must be done before the completion of your transaction. This includes checking the title deed and contract of the property. It also involves verifying the reputation and experience of the developer. Additionally, inspecting the condition of the property is necessary for completed properties.

Importantly, all transactions involving the actual purchase of a home in Dubai must go via a licenced real estate broker or agent. This is because all real estate transactions in Dubai are subject to laws and regulations that are in place to safeguard both buyers and sellers. These include requirements for deposits, title transfers, and mortgage applications.

The size and location of your selected property will determine how much the transaction will cost. Generally speaking, buying a property in Dubai involves paying commission (typically around 2%), transfer fees (4% – 2% each for buyer and seller), registration fees (around 1% of total value), and any other applicable taxes (such as VAT).

Documents needed for a successful purchase usually include identification (such as a passport) and proof of residence (such as bank or utility statements). Before buying a property, it’s best to talk to a professional. Depending on your situation, you may need additional documents like a marriage certificate or a trade permit.

Last but not least, getting independent legal counsel before signing any contracts when buying apartments in Dubai can guarantee that your interests are sufficiently protected in the future.

Our Tip: Hire a respectable law firm to help with the due diligence procedure and to guarantee adherence to local laws.

Step 6: Understanding the Costs and Fees

Buying an apartment in Dubai includes various fees in addition to the purchase price, such as:

- Transfer costs (usually 4% of the property’s value)

- Agency costs (should you be dealing with a real estate agent)

- Mortgage fees (where applicable)

- Common fees and maintenance charges

- Property registration fees

When thinking of buying a home in Dubai, be aware of the upkeep costs associated with apartment ownership. The service charge is among the most frequently encountered costs. This fee is paid annually. It covers costs for running the facility such as security, cleaning, maintenance, and utilities for the building. It does not cover costs for your individual unit.

Our Tip: For peace of mind, request a thorough breakdown of all expenses and fees for the apartment you are buying including service charges.

Step 7: Completing the Purchase and Registering the Property

Now it is time to move forward with the purchase after you have chosen your ideal apartment and finished the due diligence procedure:

This step involves several crucial stages:

1. Reviewing and Signing:

Carefully review the purchase contract provided by the developer or real estate agency. Ensure that all terms and conditions, including the property details, price, payment schedule, and any other clauses, are accurate and acceptable to you. Once satisfied, sign the contract.

2. Making the Payments:

Depending on the agreed terms, you will need to make the necessary payments to the developer or seller. Typically, you start by paying a deposit. After that, you can either make installment payments or pay the remaining balance once the property is completed or handed over. If you are borrowing money from a bank or mortgage lender, you must complete the loan process. You also need to provide them with the necessary documents.

3. Registering the Property:

To register the property in Dubai, make all payments and ensure documents are correct. Then, register the property in your name with the Dubai Land Department. This process involves submitting the purchase contract, title deed, NOC – No Objection Certificate (if applicable), and other required documents, along with paying the applicable registration fees.

4. Receiving the Title Deed:

After successful registration, you will receive the official title deed, which serves as proof of your ownership of the property in Dubai.

Our Tip: Make sure you have read and understand every document carefully before signing

Step 8: Things to Think About After Buying

After successfully buying your apartment, you can now enjoy your new home or rental property. There are, however, a few more things to think about:

Getting a Residency Visa:

You can be qualified to sponsor family members under the residency visa if you own property in Dubai for certain types of real estate. This option provides individuals with the opportunity to reside in the country on a long-term basis and potentially even start their own business.

Managing Your Property:

If renting out your apartment, think about enlisting the services of a respectable property management firm to take care of upkeep, rent collection, and tenant screening.

You may need to budget for personal maintenance costs, such as hiring cleaners or housekeeping staff, in your yearly budget. Regular maintenance expenses should be taken into account such as furniture or electrical items.

Choosing Insurance and Utilities Providers:

Open accounts for internet, water, and electricity as well as looking at insurance choices to safeguard your investment.

Compare house insurance plans from several insurers. Check ratings and reviews online. Consider total insured amounts, deductibles, exclusions, special terms, and incentives. Read policy documents carefully to understand coverage.

Our Tip: Keeping up with any changes to community or local laws that might affect your ability to rent out your home is also a good idea.

Buying Apartments in Dubai

Purchasing an apartment in Dubai offers appealing long-term returns, an elevated standard of living, and diverse options. Use this guide, do research, and get expert help to confidently make a choice that meets your goals.

Founded in 2014, Ellington Properties is one of Dubai’s most trusted real estate and luxury apartment developers.

A truly customer-centric developer in the UAE real estate market, we develop beautiful residences in Dubai designed by incredible artistry and impeccable architecture. Our customers’ refined tastes inspire us to create compelling luxury properties and communities for high-quality lifestyles.