Dubai’s real estate market has long been a hub for off-plan property investments, giving purchasers the chance to acquire homes before they are built. Since this strategy offers a potentially lucrative range of benefits, it has become increasingly common among both investors and homeowners. Yet, as with any investment, there are possible risks that must be navigated. In this article, we highlight the advantages and disadvantages of buying off-plan and answer some of the most commonly asked questions.

Dubai Off-Plan Property Overview

Off-plan property refers to real estate units that are sold during the development stage, frequently before or while it is still under construction. This approach is common in Dubai as it enables buyers to benefit from flexible payment terms and competitive pricing whilst developers see increasing demand for new projects. To attract buyers early on, developers offer alluring incentives, including lower prices, flexible payment plans, and waived fees. Purchasers can buy villas, apartments and houses at potentially lower prices which can make them more affordable than completed units.

For buyers seeking a desirable neighborhood or community, purchasing off-plan property is a good option to secure a unit early and avoid disappointment if the project sells out before completion. Early buyers can also benefit from having the widest choice of available units, layout and floors plus selecting their ideal customization, finishes and layouts.

As most developers provide a structured payment plan – where payments are made as the building hits certain milestones – purchasing off-plan property gives investors the chance to own property without having to pay the entire sum immediately.

When the project nears delivery, it is possible to see significant capital appreciation when interest in the property rises as a result of strong marketing, advertising, word-of-mouth, and recommendations from previous purchasers.

However, there are potential disadvantages to buying off-plan including construction delays, market fluctuations, and longer term commitment of capital that buyers have to consider.

How to Buy Off-Plan Property in Dubai?

Buying an off-plan property in Dubai is a relatively straightforward process, although there are some differences compared to other countries. The typical step-by-step process involves researching and choosing a reputable developer by thoroughly reviewing their portfolio and track record. Once you’ve identified a suitable developer, you can explore their upcoming projects and select an off-plan property that aligns with your preferences and investment goals. Ensure the project has been registered with RERA which means the developer has the necessary approvals and funding to complete the project.

If you’re purchasing as a buy-to-let investment, consider factors such as location and amenities that will give your property an edge in the rental market.

Another crucial aspect is understanding the payment plan offered. Dubai developers often provide attractive payment plans, allowing investors to pay a deposit (usually 20% of the price) and then finalize the balance in stages or upon completion. This flexible approach can be advantageous for buyers in managing their capital requirements.

Once you’ve identified the desired property, it’s advisable to work with a lawyer familiar with the Dubai market to handle the legal aspects and paperwork. Ensure that the Sale and Purchase Agreement (SPA) clearly outlines all terms and conditions, including payment plans, completion dates, and any penalties for delays. Additionally, verify that your deposit is protected in the unlikely event that the project stalls or collapses.

The next step is to register the transaction with the Dubai Land Department (DLD). This process involves paying a registration fee and ensuring that all paperwork is in order. The DLD provides security and legal recognition to your investment, offering peace of mind. After securing your investment, it’s crucial to stay informed about the construction progress and any developments in the local property market until handover.

Finally, once construction is complete, the developer will request the final balance. Cash purchases are common in Dubai, but it is possible to secure a mortgage to cover the final payment, should you wish – just be sure to obtain pre-approval and set everything up well in advance.

Can You Sell an Off-Plan Property in Dubai?

The chance to sell an off-plan property in Dubai before completion is a potential benefit. With this technique, referred to as “flipping,” investors can profit from price increases while the building is still under construction. Reselling off-plan homes in Dubai is subject to certain rules and costs, and you must always review the contract with the developer first.

When purchasers want to resell their off-plan apartment or villa before completion or ownership transfer, developers usually charge a resale fee. This charge varies according to the developer and the stage of development from a few percentage points of the property value to a fixed amount.

It’s also critical to think about market conditions and possible demand for the property when it comes time to sell. When markets are growing quickly, flipping may be a profitable tactic; yet, in recessions or oversupplied markets, it does present certain challenges in terms of lack of demand.

Are Property Prices Going Down in Dubai?

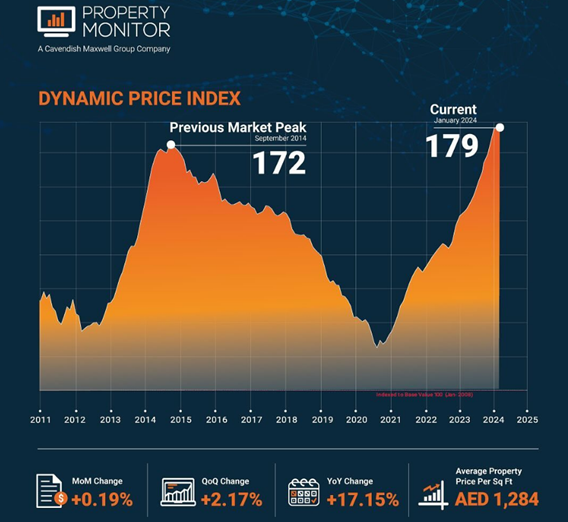

Like any other economy, Dubai’s is prone to cyclical market moves. Price reductions have occurred at times in the past, but overall Dubai has seen long-term appreciation. It is always prudent to keep in mind, though, that a number of elements, such as the dynamics of supply and demand, the state of the economy, and government policies, affect the market.

Source: Property Monitor

When there is an excess supply or when things are uncertain economically, Dubai property prices might drop. In contrast, prices usually increase during periods of robust economic expansion and increased demand. Before deciding to buy, carefully consider investment objectives and risk tolerance, carry out extensive market research, and speak with local real estate experts.

Can You Get a Mortgage on Off-Plan Real Estate?

It is possible to obtain a mortgage for a Dubai off-plan property, however the procedure can be a little different from that of a finished or completed property. Subject to specific terms and circumstances, most banks and financial institutions in Dubai provide mortgage loans for off-plan purchases.

Lenders mostly look at the developer’s track record and reputation. To make sure the projects fulfill their risk assessment standards, banks usually have pre-approved lists of developers they are ready to finance. Lenders may also demand an additional equity commitment or down payment for off-plan acquisitions, often between 20% and 40% of the property value.

Buyers seeking to understand the particular criteria, interest rates, and loan-to-value (LTV) ratios relevant to off-plan property mortgages in Dubai are recommended to speak with reputable mortgage brokers or directly with banks.

Is It Worth Buying Off-Plan Property in Dubai?

Investment goals, risk tolerance, and financial situation ultimately determine whether or not to buy an off-plan property in Dubai. There are inherent risks that should be carefully examined even if buying off-plan provides prospective advantages including more affordable entry prices, flexible payment plans, and the potential for capital growth.

Building delays or project cancellations are two of the main hazards associated with off-plan acquisitions. Unexpected events like bankruptcies of developers, regulatory changes, or economic downturns can cause major delays or even project termination. This can result in financial losses, legal conflicts, and stress for purchasers.

Off-plan homes might not always match the specifications that were promoted during the sales process. To align expectations, buyers should undertake their due diligence by carefully reviewing contracts, visiting the development in person wherever possible and monitoring the progress of the project via the DLD website.

To mitigate these risks it is essential to buy from a trusted and reputable developer like Ellington Properties. Ensure your investment is protected, and only consider registered projects by licensed developers. UAE based buyers can validate the developer through RERA or DLD, and for digital verification Dubai Rest App is available.

Always assess the risks and rewards very carefully including:

Financing and Affordability:

Flexible payment schedules that let purchasers spread out their payments over a longer time frame are a huge benefit. Make sure the financial commitment, nevertheless, fits your budget and long-term financial objectives. Ensure you consider all costs and fees due over the entire transaction process.

Legal and Regulatory:

The government of Dubai has implemented measures to protect off-plan property buyers, so make use of these platforms when considering a purchase. Always get specialist legal advice to check all contracts.

Community and Amenities:

Although off-plan projects may first be sold based on 3D renderings and brochures, it’s crucial to take into account how the neighborhood is really developing, including its amenities, infrastructure, and accessibility. The surrounding area and community can make a huge difference to the value of the property including rental yield and resale potential.

Rental Potential:

Assessing the anticipated returns and possible lease demand for the property is crucial for investors looking for rental income. Location, property type, and leasing market conditions will all affect the chances of renting and securing a high ROI.

Summary

There are clear PRO’s to buying off-plan real estate in Dubai: Buyers have a rare opportunity to obtain Dubai real estate at highly desirable pricing and profit from early capital appreciation.

Purchasers must also carefully consider the CONs and approach any opportunity cautiously and carry out extensive research into the developer and project.

Working with trusted developers, utilizing the government’s protections for off-plan buyers, and matching your investment objectives with the dynamics of the market will help you confidently negotiate the Dubai off-plan property market.